maryland local earned income tax credit

The local EITC reduces the amount of county tax you owe. Taxes paid to local municipalities in other states may apply as a credit directly against local tax liability.

How Do State Earned Income Tax Credits Work Tax Policy Center

The RELIEF Act also enhances the Earned Income Tax Credit for these same 400000 Marylanders by an estimated 478 million over the next three tax years.

. If it does the income exemption provided may differ from the municipality and can be anywhere from 0 to 11999. Using difference-in-differences DD and triple differences DDD. 50 of federal EITC 1.

Vital Statistics data covering births in Maryland from 1995 to 2004 to examine whether the local EITC impacted birth weight and the probability of low birth weight in Montgomery County. The state EITC reduces the amount of Maryland tax you owe. MORE SUPPORT FOR UNEMPLOYED MARYLANDERS.

2019 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. To claim this credit for income taxes paid to a local municipality in another state income must be subject to both the out-of-state municipal tax. Find the state to which you paid a nonresident tax in Group I II or III.

Did you receive a letter from the IRS about the EITC. 2019 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. Thelocal EITC reduces the amount of county tax you owe.

In addition the legislation increases the refundable Earned Income Tax Credit to 45 for families and 100 for individuals. In 1998 Montgomery County Maryland adopted a local earned income tax credit EITC program. 33 rows If you qualify for the federal EITC see if you qualify for a state or local credit.

The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. Marylands 23 counties and Baltimore City levy a local income tax which we collect on the state income tax return as a convenience for local governments. If you qualify you can use the credit to reduce the taxes you owe and maybe increase your refund.

New Issue Report Fri 12 Jun 2009. About 86000 people in Maryland file tax returns without using a. The state EITC reduces the amount of Maryland tax you owe.

Income from all sources is defined as the same earned income and net profits that are used to determine the local earned income tax. The local income tax is calculated as a percentage of your taxable income. Does Maryland tax income earned in other states.

Local officials set the rates which range between 225 and 320 for the current tax year. Earned Income Tax Credit EITC Rates. In May 2018 Maryland passed legislation to eliminate the minimum age requirement for the state-level EITC.

1 day agoSB 369 Establishes a program to assist low-income residents to obtain an earned income tax credit benefit if eligible. You must first have worked in jobs covered by Social Security in order to be eligible to apply for Social Security disability benefits. The MCC supported the legislation and the bill passed and was signed into law by Gov.

Claim Your Earned Income Tax Credit And Search Hundreds Of Other Deductions. Some taxpayers may even qualify for a refundable Maryland EITC. The chart shown below outlining the 2020 Maryland income tax rates and brackets is for illustrative purposes only.

The local EITC reduces the amount of county tax you owe. Some taxpayers may even qualify for a refundable Maryland EITC. Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked.

The local EITC reduces the amount of county tax you owe. Yes in addition to Wilmington DE certain cities and townships in Pennsylvania and eight other states tax the salaries and wages of Maryland residents employed within their jurisdictions. The Social Security Administration bases work credits on your total yearly wages or.

2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. STATE AND LOCAL TAX CREDIT FOR INCOME TAXES PAID TO OTHER STATES If you are a Maryland resident including a resident fiduciary and you paid income tax to another state you may be eligible for a State and local tax credit on your Maryland return. The state EITC reduces the amount of Maryland tax you owe.

Local Income Tax Rates. Ad Avoid Confusion Claim Your Earned Income Tax Credit With Our Easy Step-By-Step Process. Ii Primary Staff for This Report.

Find out what to. The earned income tax credit is praised by both parties for lifting people out of poverty. Thestate EITCreducesthe amount of Maryland tax you owe.

Retirees with Maryland income up to 50000 will pay no state tax whatsoever in the state of Maryland. If you live in a jurisdiction with an Earned Income tax in place and had wages for the year in question a local earned income return must be filed annually by April 15 unless the 15th falls on a Saturday or Sunday then the due date becomes. Some taxpayers may even qualify for a refundable Maryland EITC.

Some taxpayers may even qualify for a refundable Maryland EITC. 28 of federal EITC. Required to file a tax return.

Supporters of the bill say that allowing taxpayers without Social Security numbers to collect Marylands Earned Income Tax Credit EITC will provide much-needed aid to many essential workers who. See Marylands EITC information page.

Earned Income Tax Credit Parameters 1979 1998 In Nominal Dollars Download Table

Earned Income Tax Credit Eitc Interactive And Resources

Earned Income Tax Credit Now Available To Seniors Without Dependents

Refundable Credits The Earned Income Tax Credit And The Child Tax Credit Full Report Tax Policy Center

Irs Child Tax Credit Payments Start July 15

Summary Of Eitc Letters Notices H R Block

Earned Income Tax Credit Eitc Tax Credit Amounts Limits

Growth Profits And Wealth Blog Travis Raml Cpa Associates Llc

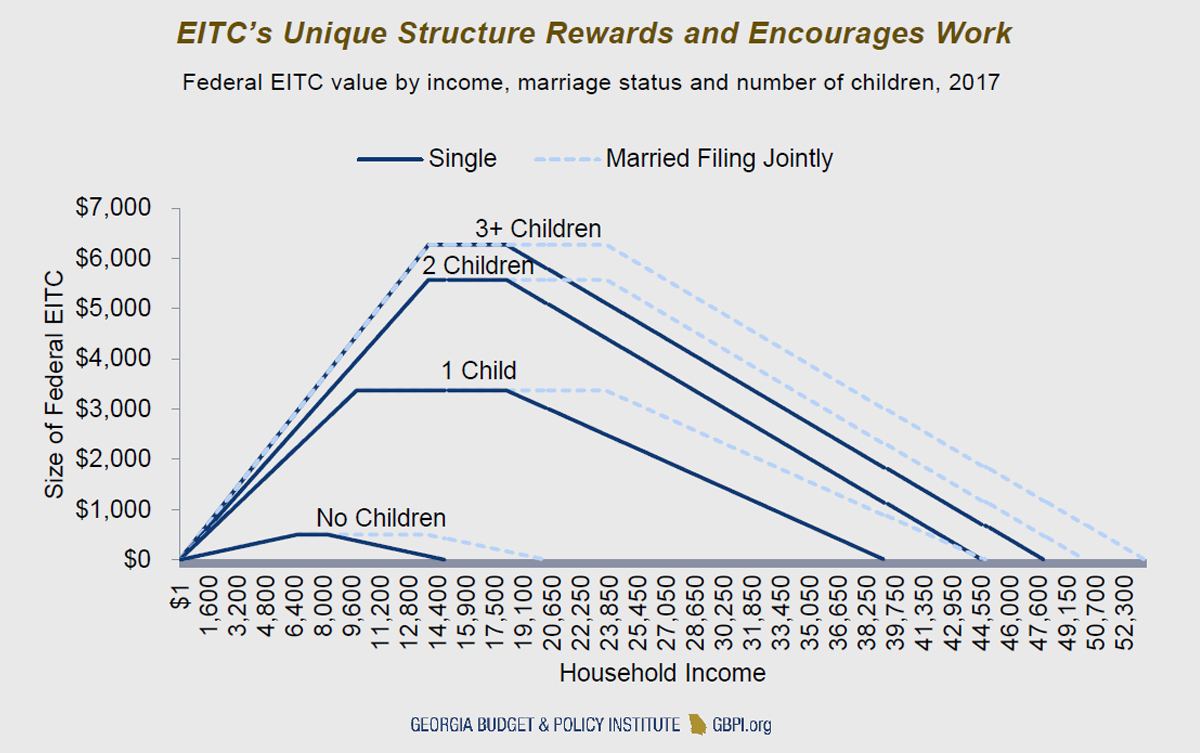

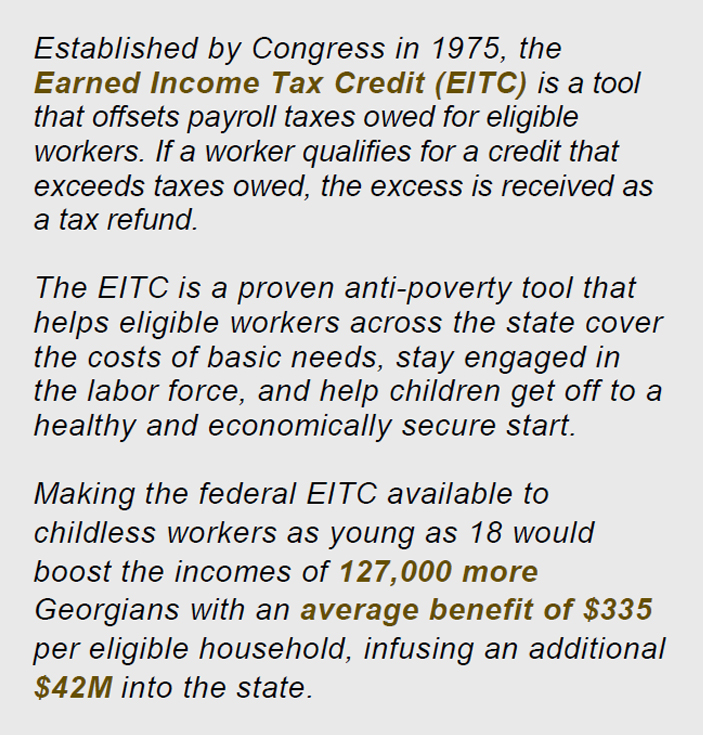

The Earned Income Tax Credit And Young Adult Workers Georgia Budget And Policy Institute

What Are Marriage Penalties And Bonuses Tax Policy Center

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Earned Income Credit H R Block

Refundable Credits The Earned Income Tax Credit And The Child Tax Credit Full Report Tax Policy Center

Earned Income Tax Credits Employee Notification Requirements

Refundable Credits The Earned Income Tax Credit And The Child Tax Credit Full Report Tax Policy Center

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

The Earned Income Tax Credit And Young Adult Workers Georgia Budget And Policy Institute